Three top tips for creating an amazing promotional banner

When it comes to promoting a business, a brand, an event, or simply informing the public, PVC banners remain the first choice, for many reasons. Get the creative design of your banner right and it will be attention grabbing and informative, and pull people into your business or event. The size and flexibility offered by

The post Three top tips for creating an amazing promotional banner appeared first on Small Business.

Tony Abbott criticises government on energy policy, same-sex marriage plebiscite

Tony Abbott has criticised the Turnbull government’s energy policy during an interview with Alan Jones and Peta Credlin.

OnePlus expands offline presence; partners Croma Retail for sales

The OnePlus smartphones were initially available exclusively through Amazon India

Markets Live: Monday, 18th September, 2017

Markets Live: Monday, 18th September, 2017

Wall St. hits new record highs as financials, industrials gain

Ryanair under pressure after messing up pilots’ holidays

Irish budget airline Ryanair was under pressure Monday to provide more information to travelers after canceling up to 50 flights a day over the next six weeks because it “messed up” its pilots’ holiday schedules.

Ryanair, Europe’s biggest airline by passenger numbers, canceled the flights because it had “messed up in the planning of pilot holidays,” its chief marketing officer, Kenny Jacobs, said Saturday.

The company promised to publish a full list of the canceled flights by Tuesday, but as of Monday there were only details on canceled flights through Wednesday.

Travelers with flights after Wednesday remained in a limbo and took to social media to vent their anger.

“How the hell do you know if you can get back. Publish full list now!” Carole Schofield tweeted.

The company offered to refund travelers for their canceled flights, in accordance with EU law, or to allow them to change their flight for free.

Shares in the airline fell 1.9 percent to 16.76 euros in Dublin in an otherwise higher market.

Analysts said Ryanair’s scheduling problems stemmed from having to harmonize Irish rules with European Union rules on how many hours pilots can fly in a certain period of time.

“The impact in terms of adverse publicity and frustration to customers is large,” said Loizos Heracleous, professor of strategy at the Warwick Business School. He does not, however, expect it to have a durable financial impact on the company, which is expanding and is adept at controlling costs and finding new sources of revenue.

In One Chart: The biggest financial regrets of millennials (clue: they had been warned)

How Arundhati Bhattacharya made SBI more relevant in just 4 years

Arundhati Bhattacharya has dealt with multiple challenges

Financial Freedom Update (Q3) Sept 2017 (+5.56%) Major Milestone!

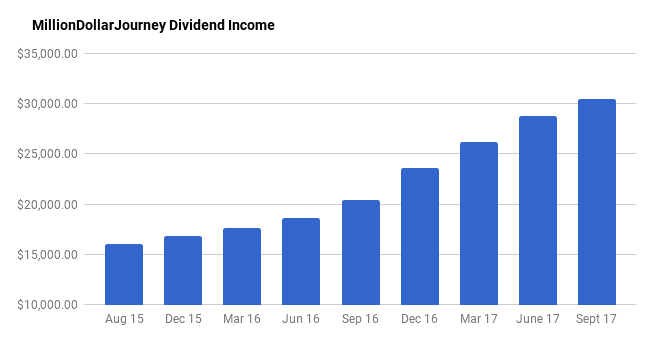

Welcome to the Million Dollar Journey September 2017 Financial Freedom Update the third update of the year. For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I haveshifted my focus to achieving financial independence. How? I plan on building my passive income sources to the point where they are enough to cover our family expenses. All within the next 53.5 years.

If you would like to follow my latest financial journey, you can get my updatessent directly to your email,viaTwitter(where I have been more active lately) and/or you can sign up for the monthlyMillion Dollar Journey Newsletter.

In my first fewFinancial Freedom updates, I talked about what life has been like since becoming a millionaire, why I like passive income, and our family financial goals going forward.

Here is a summary:

Financial Goals

Our current annual recurring expenses are in the $50-$52k range, but that’s without vacation costs. However, while travel is important to us, it is something that we consider discretionary (and frankly, a luxury). If money became tight, we could cut vacation for the year. In light of this, our ultimate goal for passive income to be have enough to cover recurring expenses, and for business (or other active) income to cover luxuries such as travel, savings for a new/used car, and simply extra cash flow.

Major Financial Goal: To generate $60,000/year in passive income by end of year 2020 (age 41).

Reaching this goal would mean that my family could live comfortably without relying on full time salaries. I would have the choice to leave full time work and allow me to focus my efforts on other interests, hobbies, and entrepeneurial pursuits.

Previous Update

To give you context for this update, here are the numbers in my previous financial freedom update.

June 2017 Dividend Income Update

Account Dividends/year Yield on Cost SM Portfolio $6,300 4.32% TFSA 1 $2,150 4.89% TFSA 2 $2,600 4.87% Non-Registered $210 1.37% Corporate Portfolio $11,000 3.69% RRSP 1 $5,800 3.70% RRSP 2 $700 2.80%

- Total Invested: $738,588

- Total Yield on Cost: 3.89%

- Total Dividends: $28,760/year (+9.73%)

Current Update

Since June, there has been a significant change to our financial position. In a recent post about retirement income sources, I hinted about job instability within the provincial government (NL). Well it happened, I was laid off, but accepted a lower paying temporary position which gives me an opportunity to apply for government jobs as they come up.

The whole situation has me pondering my career and life in general. I generally tend to look at things from a positive perspective where I firmly believe that when one door closes, at least two more open. When I look back at major turning points in my work life, things have always worked out for the better.

If I didn’t join my previous engineering employer (I had a choice of three employers), I wouldn’t have met a co-worker that pushed me in the direction of starting this blog. This site has been such a big part of my life that I honestly cannot imagine what my life would have been like without starting MillionDollarJourney.com.

So, now what? For now, I stick with the temporary job and look for opportunities that interest me. I’ve even contemplated early semi-retirement where we live off dividend income supplemented with part-time online and/or contract work. The laptop lifestyle with full autonomy does have a certain appeal to it. In fact, it’s how I imagine life when we hit our passive income goal. Whatever happens, I’ll keep you updated within these financial freedom update posts.

Now, let’s talk a bit about my passive income strategy generating dividend income. As dividends are the main focus of my passive income pursuit, there is a large dependence on the market. While there are merits to this investment strategy, there are also substantial risks particularly dividend cuts. As an example, you may have heard about what happened to Home Capital Group (HCG). This is a secondary lender who had a very strong track record of dividend increases (18 years in a row). HCG funded their mortgages through client deposits into GICs and high-interest savings accounts. With the company under investigation, client essentially made a run at the bank and essentially wiped out HCG’s high-interest savings balance. To help stop the bleeding, HCG obtained a very expensive line of credit. The deal was so expensive that it could end up wiping out a full year of earnings. In light of this, the company suspended their dividends in May.

The goal of the strategy is to pick strong companies with a long track record of dividend increases. On the topic of dividend increases, 2017 is doing great so far. We’re three-quarters through the year, and there has been a large number of dividend increases in my portfolio. I have received raises from (there may be more that didn’t make this list):

- TD Bank (TD); Scotiabank (BNS); Magna (MG); Royal Bank (RY); CIBC (CM); Bank of Montreal (BMO); National Bank (NA); TransCanada (TRP); Great-West Life (GWO); Thomson Reuters (TRI); Manulife (MFC); BCE (BCE); Telus (T); Enbridge (ENB); Enbridge Income Fund (ENF); Canadian Utilities (CU); Canadian National Railway (CNR); Canadian Pacific Railway (CP); Exco Technologies (XTC); Suncor (SU); Thompson Reuters (TRI); Leons Furniture (LNF); First National Financial (FN); Power Financial (PWF); Transcontinental (TCL.A); Imperial Oil (IMO); George Weston (WN); Sun Life (SLF); CAE (CAE); Canadian Western Bank (CWB); Fortis (FTS); Empire (EMP.A); and, Metro (MRU).

In addition to the dividend raises, I’ve continued to deploy cash into dividend stocks. I’ve been a bit slower deploying corporate cash his quarter, but hope to continue moving forward this coming quarter. Since this is currently my largest investment account, it also adds the most weight to my overall holdings.

In my overall portfolio, here are my current top10 largest holdings (besides cash):

- Bank of Nova Scotia (BNS);

- Fortis (FTS);

- Bell Canada (BCE);

- TransCanada Corp (TRP);

- Emera (EMA);

- Canadian Utilities (CU);

- Enbridge (ENB);

- iShares Core MSCI All Country World ex Canada Index ETF (XAW) (mostly from my wife’s RRSP);

- CIBC (CM); and,

- Royal Bank of Canada (RY).

September 2017 Dividend Income Update

| Account | Dividends/year | Yield on Cost |

| SM Portfolio | $6,400 | 4.35% |

| TFSA 1 | $2,400 | 4.90% |

| TFSA 2 | $2,750 | 4.87% |

| Non-Registered | $210 | 1.37% |

| Corporate Portfolio | $11,700 | 3.62% |

| RRSP 1 | $5,850 | 3.72% |

| RRSP 2 | $1,100 | 2.36% |

- Total Invested: $795,071

- Total Yield on Cost: 3.82%

- Total Dividends: $30,410/year (+5.74%)

Through a combination of deploying cash and collecting those juicy dividend increases, this quarter has been decent with a 5.74% bump in dividend income. While the growth is good, at this point, it’s looking less likely that I’ll hit $35,000 in dividend income by the end of the year.

We still have a long way to go to hit $60k, but for the most part, we are moving in the right direction in hitting the midway point of my longer term goal. There is still cash available to deploy in most of our accounts. In particular, the lump sum of cash from the commuted values of the pensions has started to be invested but still a lot left to deploy.

We are also in the process of ramping up our non-registered account to invest in more dividend stocks (setting up another account with MDJ reader favorite Questrade). That’s in addition tothe dividends that are constantly being churned out which gets deposited as cash and reinvested again (the power of compounding).

The biggest risk or uncertainty right now is the coming changes to the way that passive portfolios will be taxed within private corporations. The good news is that existing portfolios will get grandfathered rules, but this will require some further tax planning down the road.

If you are also interested in the dividend growth strategy, here is a recent post on how to build a dividend portfolio. With this list, you’ll get a general idea of the names that I’ve been adding to my portfolios. If you want a simpler investing strategy that outperforms most mutual funds out there, check out my top ways to index aportfolio.

Let me know if you have any questions by leaving a comment.

Oh, and don’t forget to check out my presentation at the Canadian Financial Summit starting September 13. It’s is 100% free for the first 48 hours after the video goes live.